Call our lawyers

now

or,

have our lawyers

call you

Calculating Capital Gains Tax in Australia

Updated on Jan 24, 2024 • 12 min read • 974 views • Copy Link

Calculating Capital Gains Tax in Australia

Calculating Capital Gains Tax (CGT) can be quite complex depending upon the type of asset acquired when it was purchased and how it was disposed of. This page provides a brief outline of what is involved when calculating CGT.

What is CGT?

CGT is a form of taxation levied by the Australian government on CGT events. A CGT event arises whenever a relevant transaction occurs. This is most commonly a sale that results in a capital gain or a loss with respect of a CGT asset. CGT assets can be almost any kind of property, including commercial premises, land, and share portfolios.

You can find out more about CGT in our article, Capital Gains Tax in Australia.

How do you begin Calculating Capital Gains?

The first step in calculating the CGT liability to assess whether a person has made a capital gain or a capital loss. To determine whether there has been a capital gain or loss, you must determine the cost base and the proceeds.

The cost base is calculated by reference to several elements:

- The amount the person originally paid for the asset;

- The transaction costs a person incurred buying and selling the asset, such as real estate agent’s fees and advertising costs;

- The non-capital costs of owning the asset, such as costs of repairs and maintenance, insurance, and land tax;

- The capital expenditure spent towards increasing or preserving the asset value. For example, the expenditure on renovations; and

- The capital expenditure to establish or prove title. This is the legal ownership of the property.

The proceeds are the amount of money that the person received or became entitled to receive, when the asset was sold. This does not apply if that amount is not less than market value. For more on this, see section 116-25 of the Income Tax Assessment Act 1997.

If the amount the person is entitled to receive is not paid, the proceeds value are reduced to what was actually received.

The capital gain or loss can then be calculated:

- If the proceeds amount is larger than the cost base, the person has made a capital gain. The exact amount of the gain is the difference between the proceeds and the cost base.

- If the proceeds amount is smaller than the cost base, the person has made a capital loss. The amount of the loss is the difference between the cost base and the proceeds.

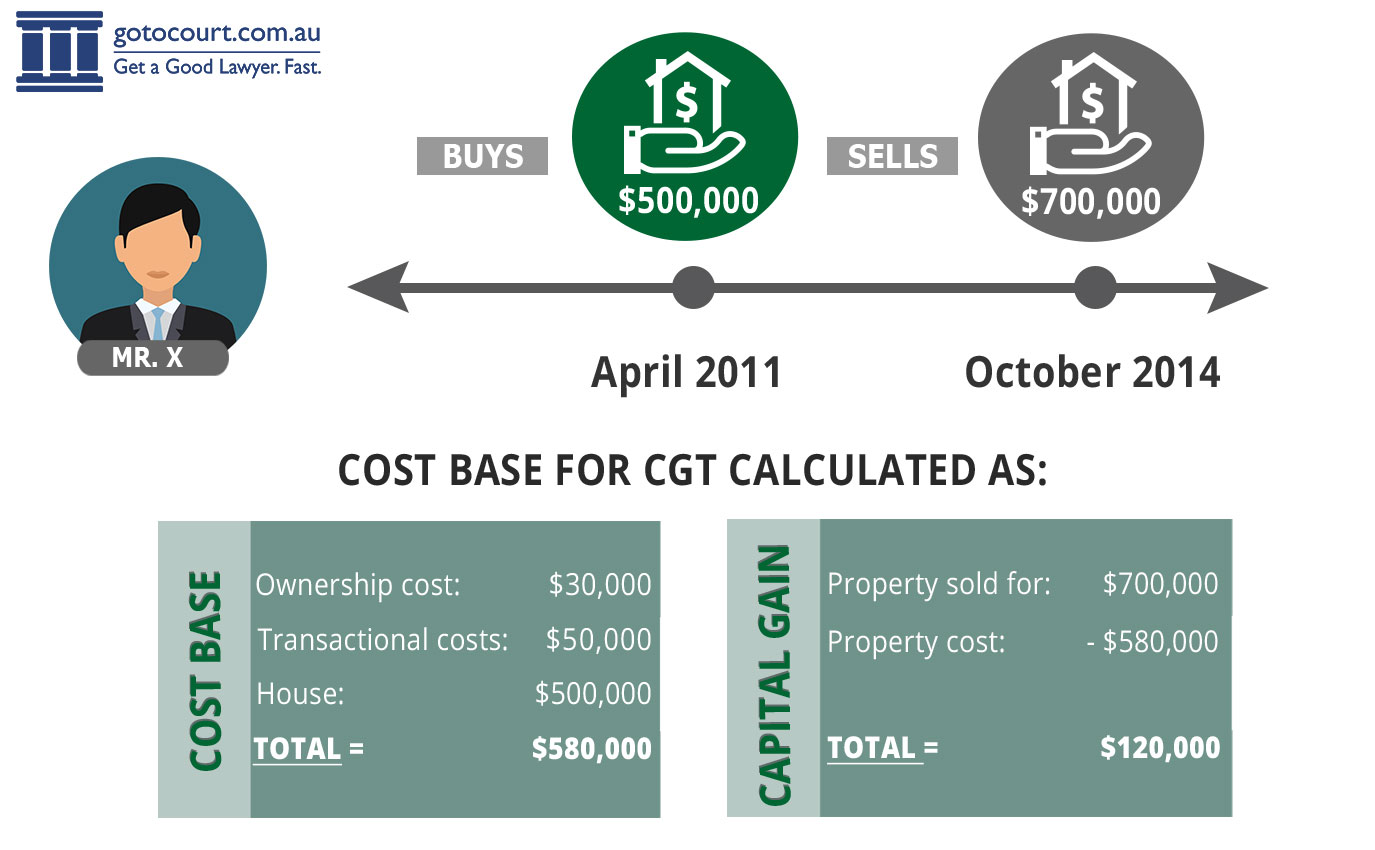

Example 1: In April 2011, X purchased an investment property for $500,000. X sold the property in October 2014 for $700,000. In purchasing and selling the property, X incurred $50,000 in transactional costs. These included real estate agent fees, advertising costs and conveyancing costs. During the three and a half years in which X owned the property, a further $30,000 was incurred in ownership costs which were rates, repairs, and land tax.

The cost base for CGT purposes would include the total original purchase price ($500,000) plus all the costs involved in the transaction ($50,000) plus the ownership costs ($30,000). A total of $580,000. With a sale price of $700,000 it is clear the proceeds are larger than the cost base. The total capital gain on the sale of the property can be calculated as $700,000 less $580,000, totalling $120,000.

Variations in the formula when calculating CGT

There are variations in the formula for calculating CGT when making calculations for particular types of assets. These include contractual rights or disposal of trust assets to a beneficiary which ends their right to income.

The different types of CGT events, the categorisation number, and the method of calculation are set out in full in section 104-5 of the Act. If the GGT event can fall within multiple categories, a more specific category will be used.

Example 2: When a trustee pays a beneficiary the entire trust property to which the beneficiary is entitled, this will constitute both:

- a ‘A1 disposal’ of a CGT asset; and

- a ‘E6 disposal to a beneficiary’ to end their right to income under the trust.

Here, the appropriate CGT event would be E6, for which the rules which apply are located in section 104-45, as it is more specific to the circumstances.

Reduced cost base

When calculating CGT requires you to use a reduced cost base, the calculation is made by considering all the same elements as for determining the cost base, less the non-capital costs of owning the asset. Remember: the non-capital costs of the asset are the costs in relation to maintenance and repairs.

Indexation

If a CGT asset was purchased prior to 21 September 1999, the value of a gain or loss can be indexed to take into account the passage of time and changing value of the dollar.

To calculate CGT in these circumstances, the value of indexation for the quarter ending 30 September 1999 (being 123.4) is divided by the value of indexation for the financial quarter when the expenditure was incurred. This provides the indexation factor.

A table of the relevant indexation values is set out in section 960-280 of the Act. Each element of the cost base or reduced cost base is multiplied by the indexation factor.

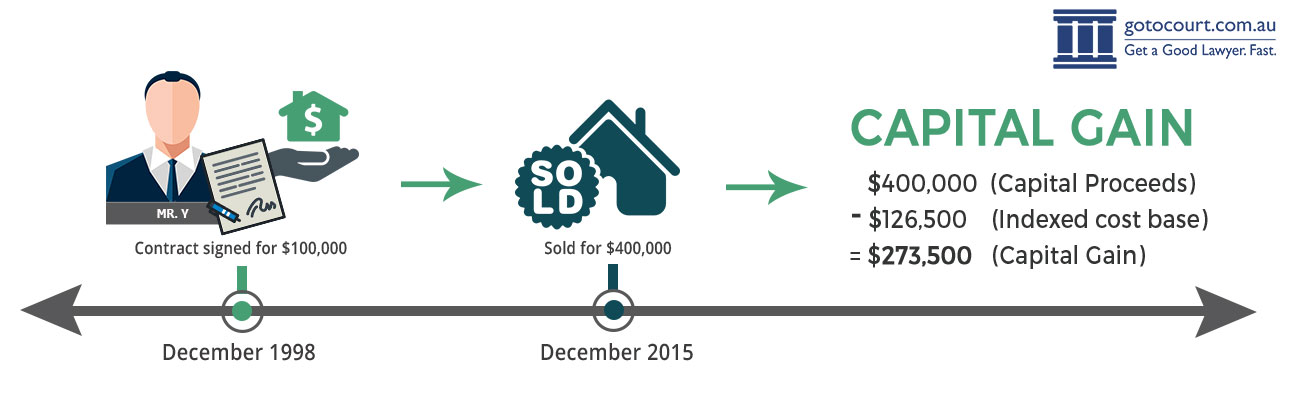

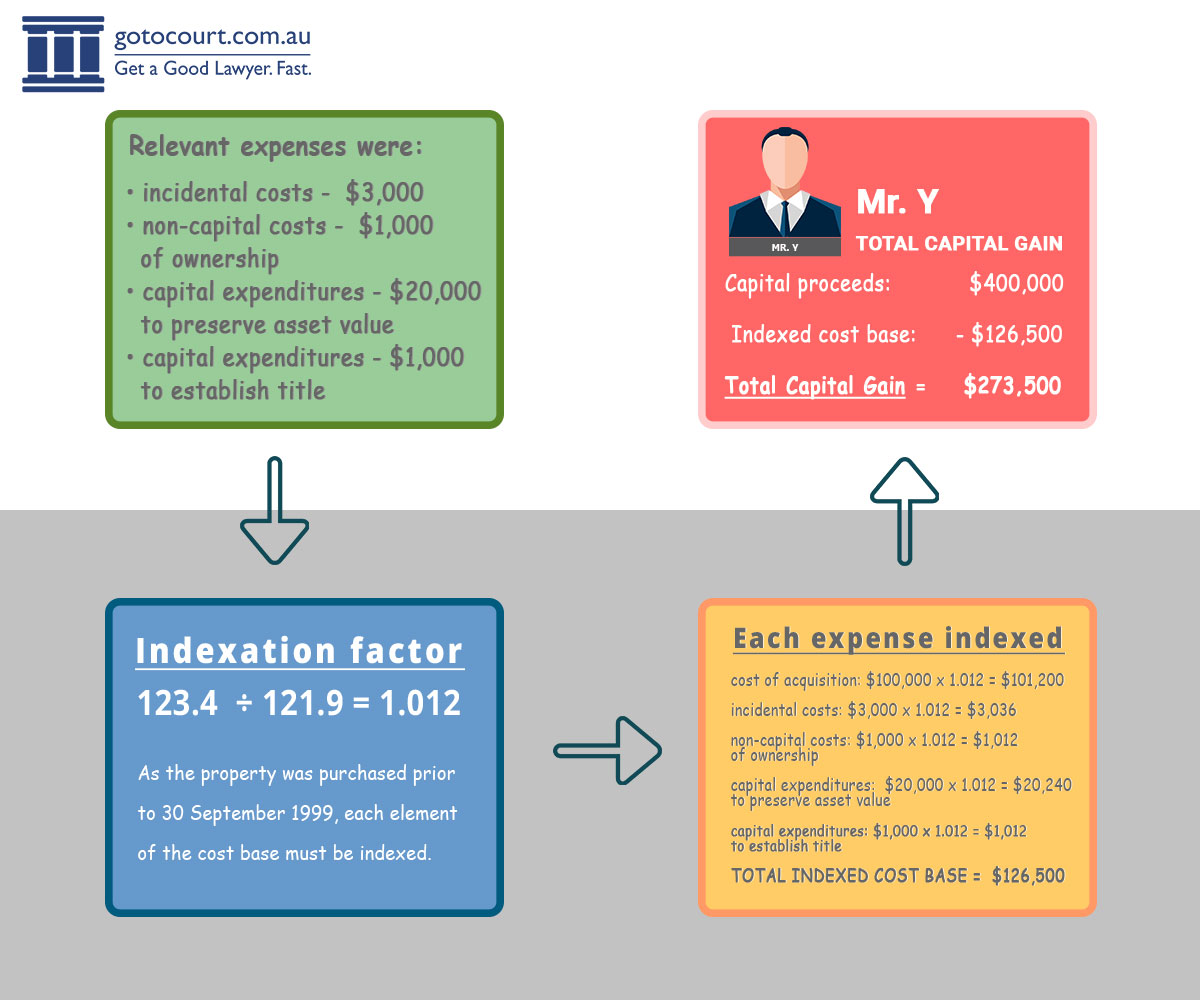

Example 3: Y signed the contract for a house for $100,000 on 1 December 1998 and signed a contract of sale for the house on 3 December 2015 for $400,000. Relevant expenses were:

- incidental costs amount to $3,000;

- non-capital costs of ownership amount to $1,000;

- capital expenditures to preserve asset value amount to $20,000; and

- capital expenditures to establish title amount to $1,000.

- The total cost base equals $125,000 and the capital proceeds equal $400,000.

As the property was purchased before 30 September 1999, each element of the cost base must be indexed. The indexation factor is 1.012. The indexation factor was found by dividing 123.4 by 121.9.

121.9 represents the indexation value for the December 1998 quarter.

The indexed expenditure on the house is:

- cost of acquisition: $100,000 x 1.012 = $101,200

- incidental costs: $3,000 x 1.012 = $3,036

- non-capital costs of ownership: $1,000 x 1.012 = $1,012

- capital expenditures to preserve asset value: $20,000 x 1.012 = $20,240

- capital expenditures to establish title: $1,000 x 1.012 = $1,012.

The total indexed cost base therefore equals $126,500. The capital proceeds are $400,000.

Therefore, the capital gain will be $273,500 (the proceeds minus the indexed cost base).

Carrying over a capital loss to reduce CGT

Capital gains and capital losses affect the size of a person’s pool of assessable income for a particular financial year. In Australia, the financial year runs from 1 July to 30 June. A person’s pool of assessable income is then taxed as a whole according to the current taxation rates. A larger pool of income may attract a higher rate of tax.

If a person makes a capital gain, the amount of the gain will be added to their pool of assessable income. In example 1 above, if X earned a salary of $70,000 in the 2015 / 2016 financial year, this amount will be added to the $120,000 capital gain, bringing X’s assessable income up to $190,000.

If a capital loss arises, the amount of the loss can only be deducted from any capital gains made in that year to reduce the size of the assessable income pool. It cannot be offset against income. However, if you make a capital loss but do not make a capital gain in the same financial year, you can carry the loss over into another financial year and deduct it from a future capital gain. Since capital losses can only be applied to reduce capital gains, they are often described as quarantined.

Example 4: Z purchased shares in a company in August 2014 for $30,000 and decided to sell them in May 2015. Unfortunately, the company’s share price had fallen since Z purchased the shares and they were sold for only $20,000. The cost base is $30,000 and the proceeds are $20,000, resulting in a capital loss of $10,000. Z has made no capital gains in the 2014/2015 financial year.

Again in August 2014, Z purchased shares for a different company for $30,000 and decided to sell them in October 2015. The company’s share price increased and Z sold them for $50,000. The cost base is $40,000 and the proceeds are $50,000. A capital gain of $20,000 was therefore made in the 2015/2016 financial year.

For the 2014/2015 financial year, Z cannot deduct the $10,000 from the assessable income pool as no capital gains were made in that year. However, Z can carry the loss forward to the 2015/2016 financial year. The$10,000 loss can be deducted from the $20,000 gain, resulting in a net gain of $10,000.

Modifications to the general calculation

Division 118 of the Act includes a range of modifications to the general CGT calculation rules.

Discount rule

The discount rule applies a 50% discount to a capital gain made on a CGT asset when the asset has been owned for at least 12 months prior to the CGT event. For example, if a person has owned a property for more than 12 months, the gain of $100,000 made on the sale of the property will be discounted to $50,000 (50% of the gain).

There are a number of exceptions to how the individual discount rule applies.

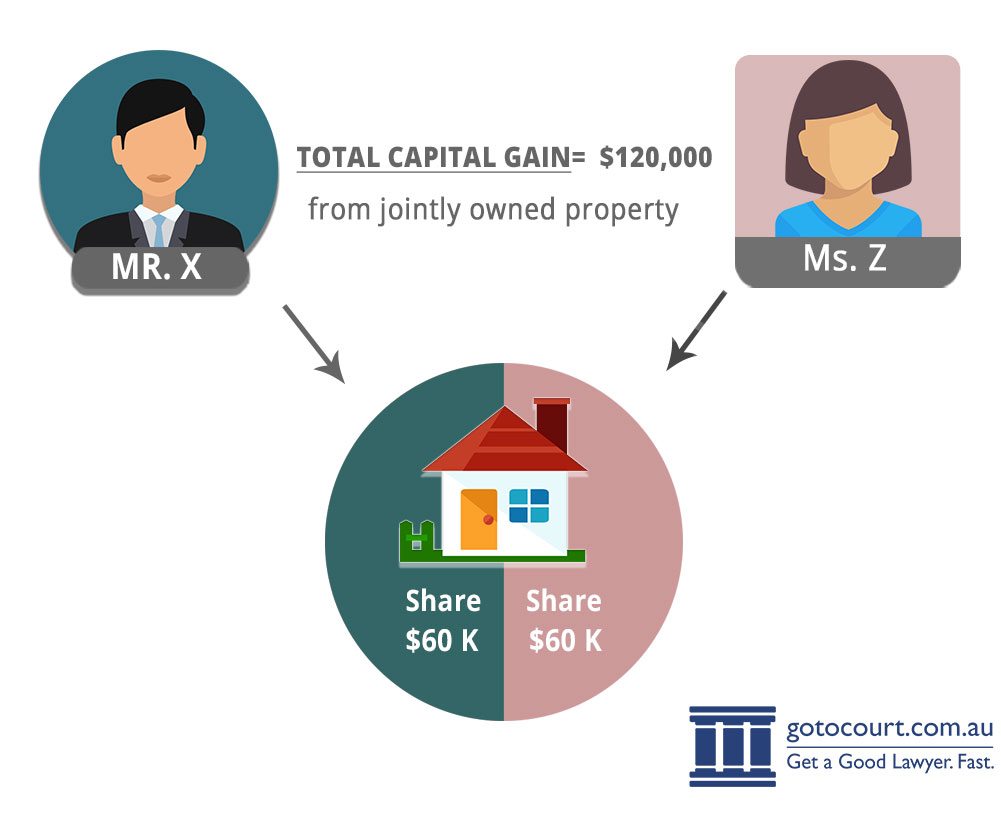

Joint ownership

Gains made on jointly owned CGT assets must be divided by the proportion of ownership. For example, a partner of a partnership makes a gain on the sale of a jointly owned property. The proportion of the gain made on the sale is 50% if the proportion of the ownership was 50%. The person would only have to pay tax on the proportion of the gain made. This means that only half of the total gain will be added to the person’s pool of assessable income, resulting in that person paying less tax. This does not apply to companies, however.

Combining discount and joint ownership rules

A person who is a partner of a partnership or a trust makes a capital gain on the sale of an asset they owned for at least 12 months. The capital gain made can be discounted by the proportion of their ownership in that asset. If they owned 50% of the asset, the capital gain can be discounted by 50%. The capital gain will also be discounted further by the individual discount rule.

Joint owners of a CGT asset should therefore not include the entire capital gain or loss relating to the disposal of that asset in their taxes. Instead, they should include an amount which represents the proportion of the asset that they own. If, for example, you and your partner own an investment property in equal shares, each of you should only include half of any capital gain made on the sale of the property in your assessable income.

Example 5: If in example 1 above X jointly owned the investment property in equal shares with Z, the portion of the capital gain is only $60,000 for each. X and Z can have taken advantage of the individual discount rule which applies because the property was owned for more than 12 months.

In addition, Z could also offset the $10,000 capital loss resulting from the sale of shares in the 2014/2015 financial year.

Capital losses should be deducted from capital gains before the individual discount rule is applied. This means that Z would need to deduct the $10,000 loss from the $60,000 gain first, leaving a total of $50,000. After applying the 50% discount, Z will only need to add a $25,000 net gain to their assessable income.

CGT for different classes of asset

Different rules apply for calculating CGT under division 108 of the Act, when the asset is classified as either:

- A collectable asset; or

- A personal use asset (div 108).

Collectable assets class rules

Collectable assets include, for example:

- Artwork, jewellery, a rare coin, an antique, or a medallion;

- A rare book, manuscript, or folio; or

- A postage stamp;

that is obtained primarily for the taxpayer’s enjoyment or personal use. The full definition can be found under section 108-10(2)-(3) of the Act.

Generally speaking, capital losses from the disposal of a collectable can only be offset against a capital gain made from collectables.

However, this does not apply if the collectable asset’s cost or cost base is $500 or under.

The rules that apply to collectable assets are as follows:

- Any capital losses can only be offset by capital gains made on other collectable assets;

- Any capital losses can be carried forward to later financial years;

- If the collectable consists of a set and would ordinarily be disposed of as a set, the disposal of the individual items will be construed as the disposal of parts of a single CGT asset. This means the $500 or under exemption under section 118-10 will not apply;

- Non-capital costs of ownership will not be taken into account when assessing its cost base;

- A gain or loss will not be taken into account if the cost of acquisition was $500 or under unless it relates to an artwork. In the case of artwork, the exemption will only apply if the market value of the collectable asset was $500 or under when acquired.

Personal use class rules

Personal use assets are defined as:

- A CGT asset, or an option to purchase such an asset, that is not a collectable but is used primarily for the taxpayer’s personal use and enjoyment;

- A debt which arises from a CGT event involving a CGT asset, that is not a collectable but is for the owner’s use or enjoyment; or

- A debt which arises other than:

- A debt incurred while producing or gaining assessable income; or

- A debt incurred from carrying on a business.

If there is a CGT event relating to a personal use asset, the following specific rules apply:

- Any capital losses will be ignored;

- If the collectables are part of a set and would usually be sold or disposed of as a set, disposal of a part or parts of the set will be considered to be disposal of part of the CGT asset, so you cannot claim the exemption under section 118-10;

- Non-capital costs of ownership will not be taken into account when assessing its cost base; and

- A gain or loss will not be taken into account if the cost of acquisition was $10,000 or less pursuant to the specific exemption under section 118-10.

Complying with your CGT obligations

In order to make sure you claim the correct CGT amount, it is important that you keep all invoices, receipts, and other relevant records. You should also consider seeking professional advice in relation to your CGT obligations to avoid later penalties.

Go To Court’s quick CGT event summary document can be found here.

If you require legal advice or representation in any legal matter, please contact Go To Court Lawyers.

Affordable Lawyers

Our Go To Court Lawyers will assist you in all areas of law. We specialise in providing legal advice urgently – at the time when you need it most. If you need a lawyer right now, today, we can help you – no matter where you are in Australia.How It Works

1. You speak directly to a lawyer

When you call the Go To Court Legal Hotline, you will be connected directly to a lawyer, every time.

2. Get your legal situation assessed

We determine the best way forward in your legal matter, free of charge. If you want to go ahead and book a face-to-face appointment, we will connect you with a specialist in your local area.

3. We arrange everything as needed

If you want to go ahead and book a fact-to-face appointment, we will connect you with a specialist in your local area no matter where you are and even at very short notice.